Filling rental applications usually suck. You need to provide so many documents that sometimes it’s hard to even keep track of which ones you’ve already submitted. Landlords will ask for a credit check, bank account number, social security, application form, application fee, pay stubs, W-2s, security deposits, and the list goes on.

By the end of the application, you feel like you have exposed your whole life and that now this landlord probably knows you better than your own mom. What throws a lot of people off, though, is when landlords require recent bank statements. How dare them? That’s so private!

So why would renters need bank statements? Usually, renters will need bank statements if they can’t prove they have a reliable and verifiable source of income. Landlords need to make sure tenants will be able to afford to pay rent even if something goes wrong in their life.

Who Needs a Bank Statement for Rental Applications

If you’re a full-time student, unemployed, or have most of your income coming from a variable source, landlords will most likely ask for your 2-3 most recent bank statements. They won’t be looking for income coming in, only at what your accounts’ bottom-line is.

While providing your bank statements to a stranger might sound a little sketchy, there’s no reason to be concerned. They’re very easy to obtain, and landlords would have to REALLY go out of their way to do anything malicious with them. We’ll cover some of the main points below so you can rest assured that you’ll have no issues.

What you will find on this page:

- Getting a Bank Statement for Rental Application at:

- JP Morgan Chase

- Bank of America

- Citi

- Wells Fargo

- U.S. Bank

- TD Bank

- PNC Bank

- Capital One

- How to Hide Transactions from Your Bank Statament

- Can Landlords Do Anything Malicious With Your Bank Statement?

- Providing Additional Sources of Funds to Landlords

Getting a Bank Statement for Rental Application

Bank statements are pretty easy to obtain. The times where you had to go to your local bank and request one are over, and now everything can be done online. This is how you can get your bank statement from some of the major U.S. banks (information straight from their websites):

JP Morgan Chase:

If you have an account at JP Morgan Chase, you can find up to 7 years of bank statements. All you need to do is log into your online account, select the Statements tab and choose the year of the statement you wish to see.

Bank of America:

If Bank of America is your bank, you need to sign in to your Online Banking account. If you haven’t signed up yet, it’s pretty easy to do so. Once you have signed in, you should go to the Statements & Documents tab, select the year of the statement you’re looking for, and then select the right month. If you can’t find the statement you’re looking for, you can click on Request Statement. After that, you should receive an email within 1-2 days with a link to your statement.

Citi

As a Citi client, you should automatically receive an email every month with a link to your bank statements. If you can’t find the email or you need older statements, you can just log into your online account at their website and find your statements.

Wells Fargo

Finding your bank statement at Wells Fargo is also pretty simple. All you need to do is log into your online account and find the right statement. If you’re looking to print or download the statement, you will need to be using a computer.

U.S. Bank

U.S. Bank allows customers to find statements both using their website or the mobile app. For the website, customers need to login, select My Accounts, go to My Documents, and finally select Statements. Then, you just need to select the right account and date of the statement.

For the mobile app, the process is a little different depending on the type of account you have. For credit cards or traditional accounts, you should log in, find the Account Details page and look for the View eStatements option. If you have investments accounts, you need to find the Account Details page and then look for a reference to My Documents.

TD Bank

If you have an account with TD Bank, all you need to do is log in, and then click on the following:

- The account you wish to view;

- Statements;

- Select the right date for the statement;

- View Statement.

PNC Bank

PNC’s process is very standard. You just need to log in, select the account and the right period for the statement. You can then either print it or save your version locally.

Capital One

You can check your online statement from a computer. You need to log in, select the Accounts tab, and finally select Statements and Documents. Then, select the right date and you should be good to go.

How to Hide Transactions from Your Bank Statement

Sometimes you just might not be comfortable letting your landlord seeing one or two specific things on your bank statements. As long as you’re ok letting them see your name and how much money you had in the account at the end of the month, they should be able to accept it. I’ve covered some information in the past (I believe I didn’t want them to see my account number for some reason) so I just “taped” it out and they were ok with it. It’s pretty simple and this is how you can do it:

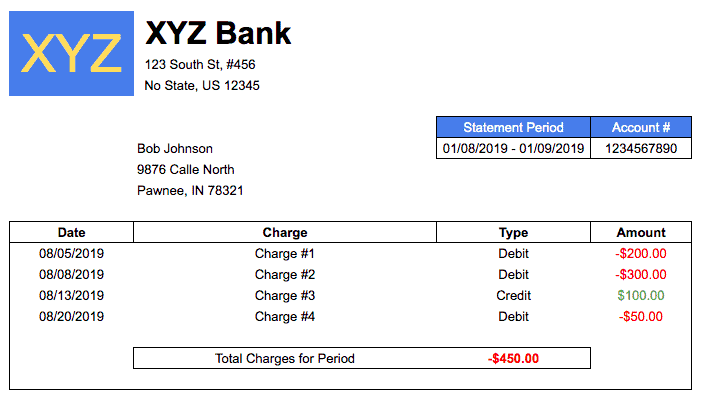

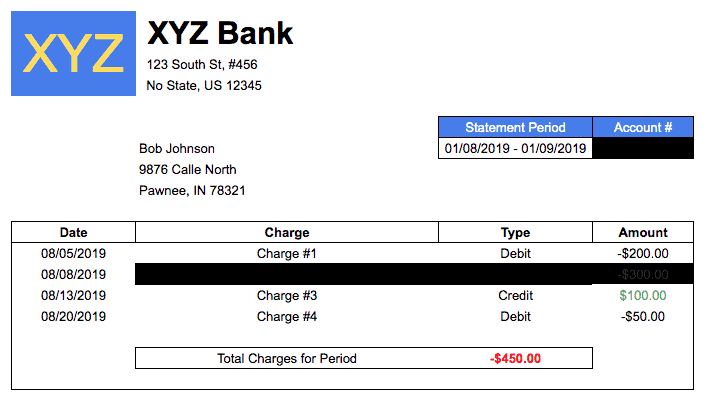

- The image below is a template of what a bank statement looks like:

- After you download your bank statement from your bank’s website, you can open it with Preview or any photo editing tool. Then, select View > Show Markup Toolbar. Then, add a Shape, set the inside and outside colors to black, and put it over the information you’re looking to hide. Voila! Your bank statement is ready to submit.

Can Landlords Do Anything Malicious With Your Bank Statement?

It is extremely hard for someone to cause you harm if the only thing they have in their possession is your bank statement. However, people are very creative when they need money. The most common issue one might have in regards to bank statements is fraudulent checks. So if someone really wants to steal money from you AND they have your bank statement, they might try printing out fake checks, adding your information (name, address, account number) and hoping that it will go through.

It is not easy to do it, but you never know. If you wish to be safe, you might want to go ahead and use the technique mentioned before to cover your account number and your address. Your landlord will have that information anyways. And that way, if someone does try to send a fraudulent check, you will only have one suspect.

Providing Additional Sources of Funds to Landlords

At the end of the day, you shouldn’t have any issues providing your bank statements to a landlord. However, this doesn’t really work for everyone because it is hard to have a lot of cash just sitting in your checking or savings account. So if you do have a solid job with a reliable and verifiable income, I’d suggest just going ahead and providing pay stubs and your W-2 and you should be good to go.